How much can i borrow with deposit calculator

Comparison rate 2This assumes 1 a loan that is for owner occupier purposes with principal and interest repayments 2 a loan amount of more than 400k but less than 700k and 3 where the amount borrowed is more than 70 but not. Choose a calculator scroll for more Basic mortgage calculator Saving for a deposit.

Lvr Borrowing Capacity Calculator Interest Co Nz

This calculator provides useful guidance but it should be seen as giving a rule-of-thumb.

. If you have no deposit and need to borrow the full amount otherwise known as needing a 100 LTV - mortgage you can still get a loan but your options will be much more limited than if you had a. You must consider the homes price the amount of your deposit and how much you can set aside for monthly mortgage payments. For this reason our calculator uses your income too.

Mortgage calculators can be useful to get a rough idea of your total borrowing but keep in mind that they are unable to take into account your personal circumstances and therefore there may be additional factors that affect the actual amount you can borrow. This will allow you to check the rates that are available to you. The bigger your deposit the smaller your loan will be and the less interest youll have to pay.

Lenders will want to know how you spend your money as part of an affordability assessment. Many people want to gift cash to their loved ones such as for a house deposit a wedding or university fees but cash gift tax implications can be substantial. Use our borrowing power calculator to get an estimate for how much you can borrow for your home loan in under two minutes.

How much can I borrow. 2000 cashback when you refinance to us If youre eligible and you apply to move your home loan to us by 28 February 2023 you could get less home load with 2000 cashback. Variable rate 1 472 pa.

Inheritance tax implications could come into play should the donor die in the years after the gift. Figure out how much you and your partner or co-borrower if applicable earn each month. This information does not contain all of the details you need to choose a mortgage.

All figures provided by our How much can i borrow mortgage calculator are an estimate only please call us to discuss your requirements in more detail. What other factors impact how much I can borrow. Use our borrowing calculator to work out how much you could borrow for a home loan to buy a house and what your home loan repayments might be.

When working out how much you could afford to borrow dont forget mortgage fees and possibly stamp duty as well as the impact of potential life changes. New EWS1 form. Include all your revenue streams from alimony to investment.

This Buy to Let mortgage calculator is designed to give you a quick idea of the likely mortgage amount you can borrow based on rental income coming in however this amount is subject to lots of different things such as your credit history monthly outgoings and deposit. Ideally you should save as much as possible before buying a home. This mortgage calculator will show how much you can afford.

As of December 2020 the. 8 calculators to compare mortgages from ditching your fix to saving for a deposit. The calculator will ask you for your income a property value and deposit amount.

If youve already started looking for properties you can enter a property value and deposit amount into the calculator and well show you your Loan to Value LTV ratio. Use this mortgage calculator to estimate how much house you can afford. Calculator can give you an estimate of the loan amount.

Woo as you can see here and based off your deposit you can roughly afford a purchase price of 300000 and your monthly repayments would be around 1290. While your personal savings goals or spending habits can impact your. See the average mortgage loan to income LTI ratio for UK borrowers.

Certificates of deposit is low. Individuals are only allowed to gift a certain amount tax-free each year. You are likely to get questions about.

How much house you can afford is also dependent on the interest rate you get because a lower interest rate could significantly lower your monthly mortgage payment. Now that the NerdWallet How much can I borrow calculator has given you an idea of your buying power you may want to gut-check the number by. The amount of interest youll pay to borrow the principal.

It will not impact your credit score and takes less than 10 minutes. Using a student loan calculator can help you create a student loan repayment strategy thats right for you. An AIP is a personalised indication of how much you could borrow.

Latest mortgages property news. How much do houses cost. Based on our Flexible home loan with Member Package option annual fee 395 which currently offers a 369 pa.

The less you can borrow. You can adjust the interest rate and also change the deposit amount in our mortgage calculator to see what difference saving for a larger deposit could make. The minimum required deposit is 10 but aim for 20 if possible.

Your income expenses and deposit are the biggest factors determining your borrowing power but lenders also consider other factors such as your existing debts and if you are using a guarantor for the loan. Mortgage calculator Find out how much you could borrow. Saving a significant amount takes time before you can afford a home.

If the same 320000 loan above has a 4 rate then you. When it comes to calculating affordability your income debts and down payment are primary factors. With some basic information about your existing or.

Our How Much Can I Borrow. If youre already a mortgage customer and you want to switch your deal please login to manage your mortgage to see what we can offer you. Factors that impact affordability.

Our borrowing power calculator asks you to enter details including your loan term and interest rate income and expenses and any outstanding debts. Youll need to obtain an Illustration before you make a decision. Calculate your monthly mortgage repayments to see what you could afford to borrow when moving house remortgaging or buying your first home.

Banks and building societies mostly use your income to decide how much they can lend you for a mortgage. Fill in the entry fields and click on the View Report button to see a complete amortization schedule of the mortgage payments Bankrate. See how much you can afford and what the approximate monthly loan repayments would be.

Start by crunching the numbers. Use our mortgage calculator to see how much mortgage you can get in the UK how much mortgage you can afford and how much deposit you need for a mortgage. Compare two mortgages Compared fixed rate mortgages.

Things like your deposit and credit rating will also be factors so remember our calculation is only a rough idea of what you. Compare home buying options today.

Pin On Loans And Loan Rates

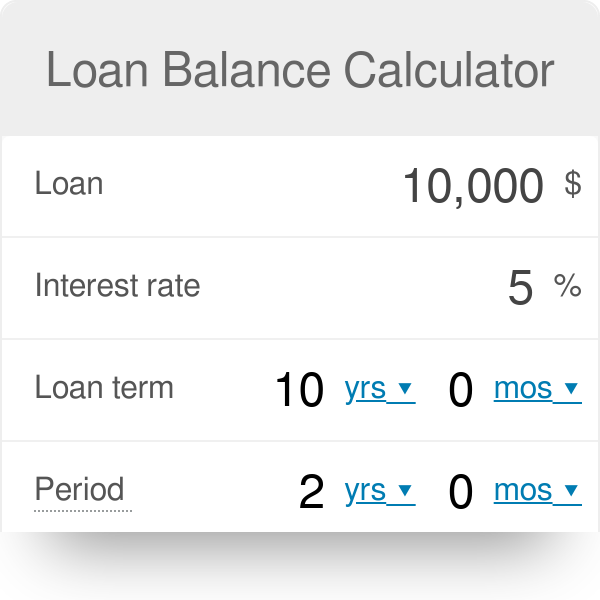

Loan Balance Calculator

Personal Loan Calculator Student Loan Hero

A Home Of Your Own Home Buying Living Room Accessories Living Room Theaters

Mortgage Calculator How Much Monthly Payments Will Cost

Loan Repayment Calculator Personal Loans Mortgages Repayments Disabled World

Slash Interest Rates With These 4 Easy Tips Refinance Loans Interest Rates Loan Rates

Need To Borrow Funds Know Which Loans Best Suits Your Needs Financial Aid For College World Finance Business Loans

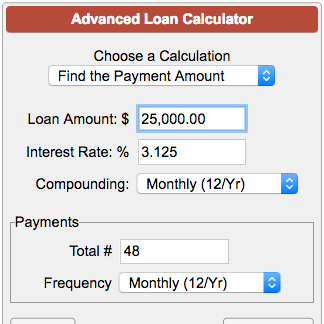

Advanced Loan Calculator

Emi Calculator Easy To Know Your Monthly Loan Payment Personal Loans Loan Calculator Paying Off Mortgage Faster

Guarantor Home Loans Borrow 105 Home Loans The Borrowers Home Buying

Financial Loan Calculator Estimate Your Monthly Payments

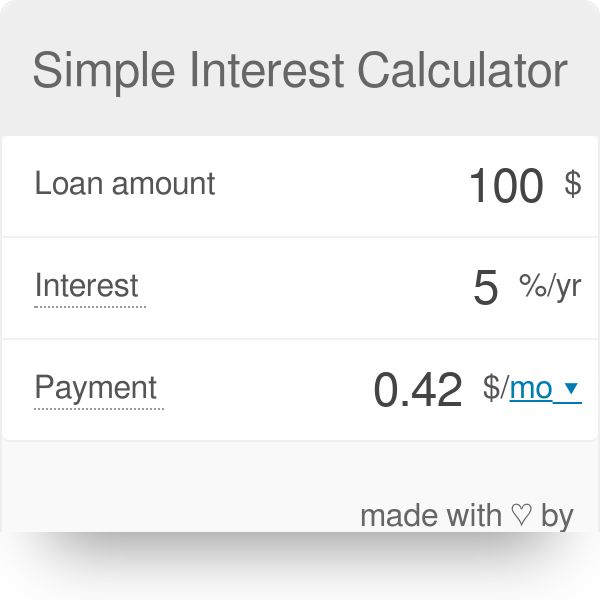

Simple Interest Calculator Defintion Formula

Loan Calculator That Creates Date Accurate Payment Schedules

Loan Calculator That Creates Date Accurate Payment Schedules

Loan Calculator Wolfram Alpha

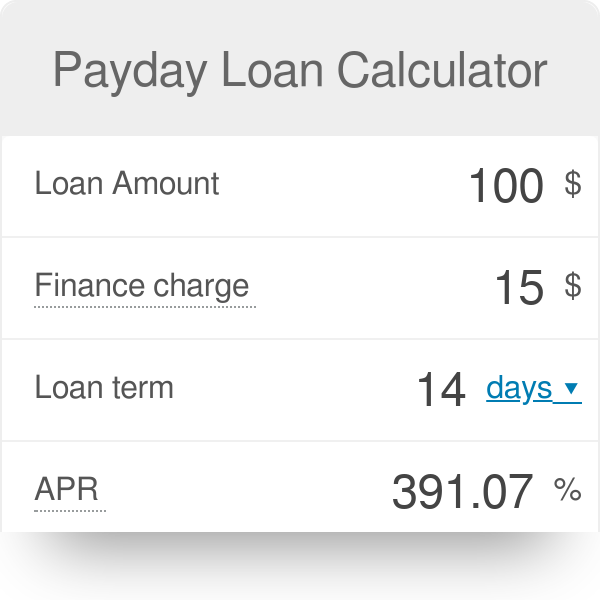

Payday Loan Calculator